Payment Gateway vs Merchant Account – What’s the Difference?

There are so many different terminologies in the business world, many of them are difficult to understand initially. But for doing business, it is essential to understand the meaning of these terminologies. Today, we will discuss payment gateway vs merchant account and differentiate and understand what they are and how they work together as both are important for nowadays growing online payments industry & eCommerce businesses.

What is a Payment Gateway?

A payment gateway solution is the technology merchants used while accepting online payments from their customers. In a retail store, the payment gateway is the POS card terminal, while in an eCommerce store Payment Gateway is being explained as where one inserts payment and personal information, or it is also being referred to as the online checkout page. The payment gateway uses industry-standard encryption while transferring the customer’s payment information to the business owner’s account, thus making the transaction much more secure. It helps give protection to both the participating parties, as well as their accounts, from fraud.

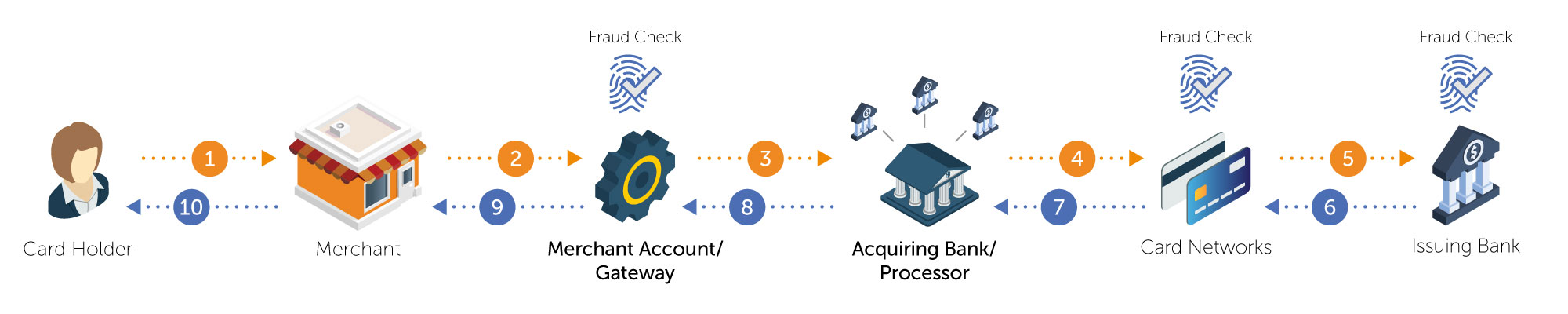

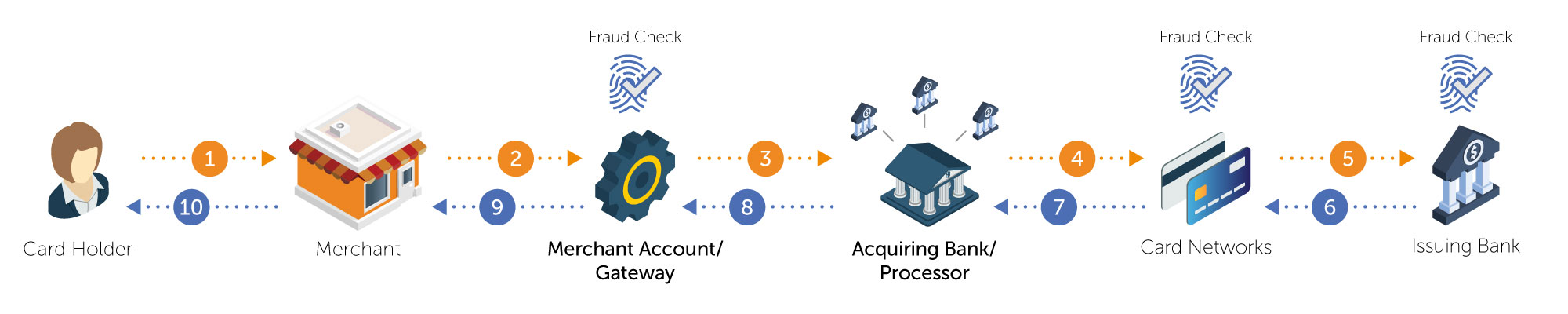

How Does a Payment Gateway Work?

In retail stores, the POS card terminal is connected to a cable to send and receive information. However, in the eCommerce store, the same piece of information is sent and received via an application programming interface (API), allowing two applications to communicate. I such case, API allows a payment gateway to communicate with a merchant account. Examples – Noon & Amazon eCommerce store checkout page.

What is a Merchant Account?

A merchant account is a specially designed business bank account for accepting online payments. Here a business creates a merchant account by partnering with merchant acquiring banks. The payment received by a business owner for a transaction initially goes into their merchant account. Any after verifying the payment, the money gets transferred from their merchant account to their bank account.

What’s Difference Between a Payment Gateway and Merchant Account?

There are several differences between a merchant account and a payment gateway. The payment gateway is the technology used for accepting or declining payments. Once the payment is accepted, the money earned from the transaction gets transferred to the merchant account, where the money is stored temporarily until it’s transferred to the business bank account.

Top Benefits of Using Payment Gateways & Merchant Accounts?

With the help of using payment gateways and merchant accounts, businesses can easily grow their customer base by offering more payments options for transactions to them. There are advantages on both sides of the transaction. Due to this, customers are offered varied, convenient payment options, while business owners stay secure about these payments.

Payment Gateway VS Merchant Account: What your Business Requires?

In case being the owner of your business, you look forward to accepting credit and debit cards as a form of payment, then you require a payment gateway and merchant account as it works together to process online payments & transactions for your store.

How to Choose the Best Payment Gateway Or Merchant Account for Your Business

For ensuring the safety of transactions, and maximum satisfaction to the customers, it’s crucial to choose the right merchant accounts and payment gateways that meet your business needs. Some of the factors that need to be considered while selecting the best payment gateways and merchant accounts include:

- Currency: Look for a merchant account that accepts the currency with which you’re currently working.

- Access: If the merchant provider lets you access the account as per your needs, go for it.

- Processing Caps: Another crucial consideration is processing volume caps. Look for the account having no monthly caps.

- Price: Payment gateways have various price points, so look for the one that fits your budget.

- Features: Look for the added features including smart chargeback management, electronic invoicing, and much more while choosing merchant account services or options in the payment gateway.

- Integration and Security: Most importantly, choose that payment gateway that is easy to integrate and has maximum security.

Conclusion

In a nutshell, we can say that merchant account and payment gateway are two different terms. A merchant account means a kind of bank account that temporarily stores customer payments until verification, while a payment gateway technology accepts POS card terminals and online payments securely.

At PayCaps renowned Payment Gateway Provider in UAE, we are offering merchant account services and payment gateway solutions to growing Big Brands and Small and medium-sized businesses in UAE & All over the Middle East.